Trade receivables are increasingly being financed with non-bank capital.

The time delay caused by the physical transport and delivery of goods has required financing for centuries. In the modern era, trade finance has been dominated by banking institutions. Over the last ten years, however, banking regulation has put increasing pressure on banks to use non-bank sources of capital to finance trade activity. This is part of a global regulatory trend to reduce risk in the banking system and has created the opportunity for investors to participate directly in this vital form of finance.

Consistent with our goal of investing in risk-return independent assets, we focus on confirmed receivables which render the financing premium distinct from the obligor risk. Trade receivables have an increasing presence in the investment holdings of institutional and private wealth investors worldwide, and in our view, well-structured trade receivables make an attractive alternative investment.

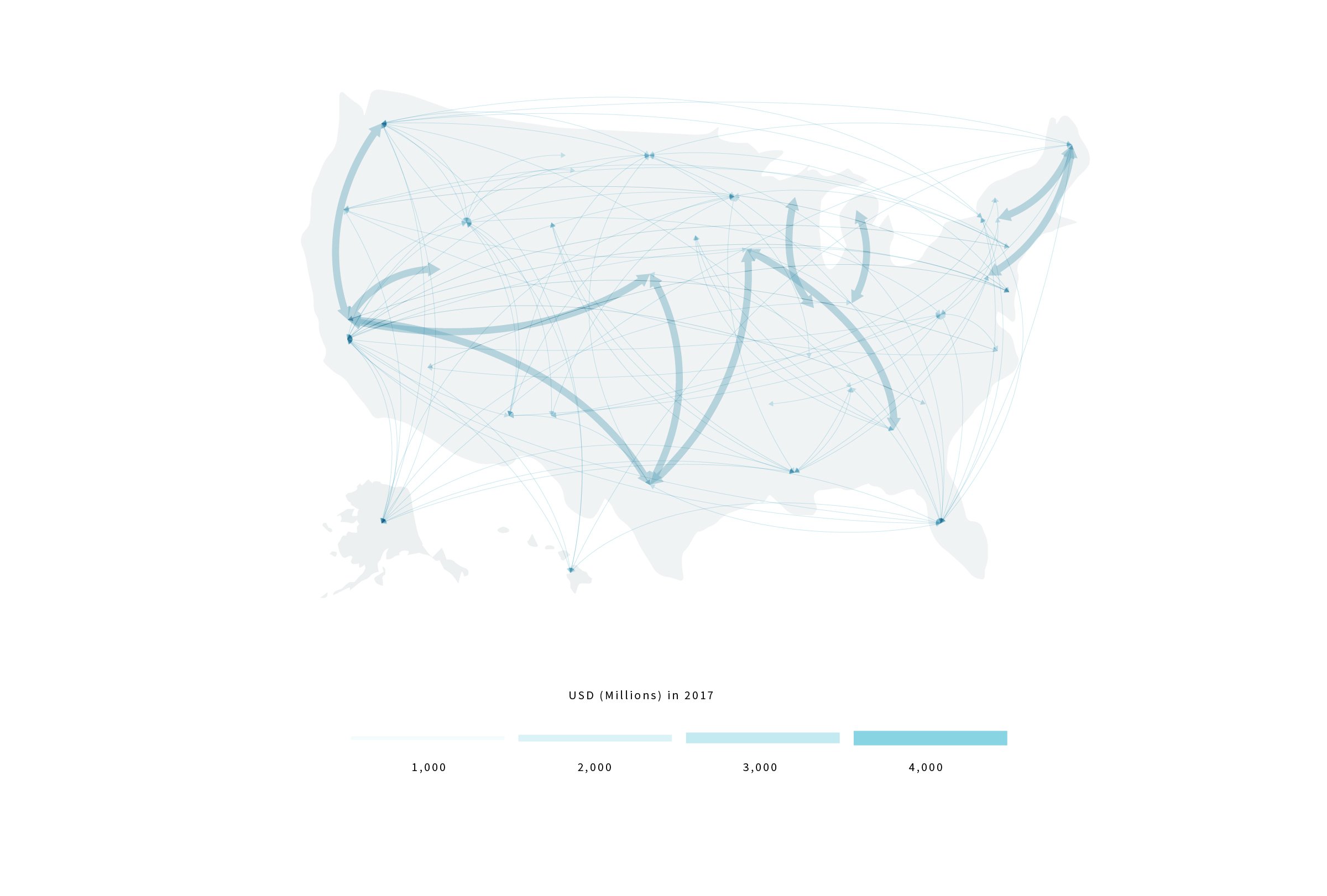

Illustrative schematic of domestic non-services trade flows for the U.S. in 2017 (in USD millions).

Source: U.S. Department of Transportation and Fermat Capital Management, LLC.

Illustrative schematic of domestic non-services trade flows for the U.S. in 2017 (in USD millions).

Source: U.S. Department of Transportation and Fermat Capital Management, LLC.