Insurance-Linked Securities (ILS) have become a critical way to finance insurance risks.

The ILS market was established in the late 1990s after two events in the U.S. caused a near collapse of the insurance markets in Florida and California. The most widely known form of ILS, catastrophe bonds, emerged as a result of a significant rise in capital requirements imposed on the insurance industry after these events. Over time, capital requirements have continued to rise as a function of more stringent regulation and an ever-increasing real estate exposure in catastrophe prone areas. ILS allow investors to respond to this need for additional capital by converting the $100+ trillion bond market into the largest de facto insurance company ever seen.

ILS investments exhibit risk-return independence as market participants receive compensation for catastrophe risks as well as an excess return for the capital relief provided to the re/insurance industry, with the risk of loss limited to insured event occurrence. For investors broadly exposed to capital market risks in their investment portfolios, ILS provide an important source of diversified risk premium. As a result, this asset class has rapidly grown as an alternative investment among institutional and private wealth investors worldwide.

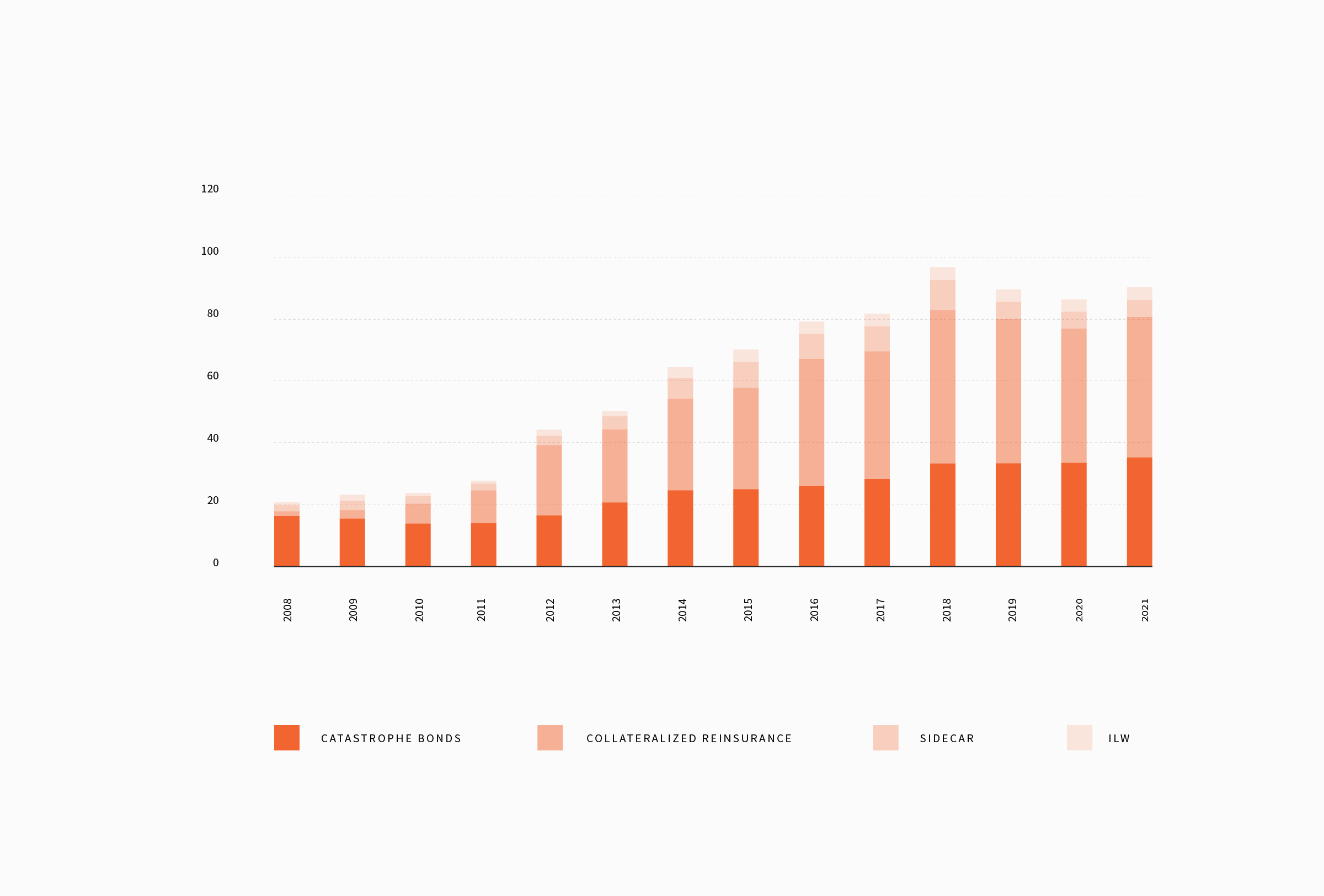

ILS market growth in USD billions by year.

USD billions on y-axis.

Source: Aon Benfield Analytics and Fermat Capital Management, LLC. Data as of June 2022.

ILS market growth in USD billions by year.

USD billions on y-axis.

Source: Aon Benfield Analytics and Fermat Capital Management, LLC. Data as of June 2022.