Insurance-linked securities (ILS) are best known as alternative investments with returns that are fundamentally uncorrelated with the broader financial market. The addition of ILS has the potential to enhance portfolio construction by providing more stable returns. Investors are also increasingly considering the positive ESG qualities of ILS. The investment proposition is compelling, but a common concern is the potential negative impact on the asset class from climate change. In reality, ILS can re-price their returns to climate change in the short term, and investors are adequately compensated for climate change risk.

Weather is one of the main risks underpinning investments in the re/insurance sector [1]. Consequently, the ILS market is at the forefront of monitoring the impact of climate change on economies. Climate change has not yet manifested itself in an increased frequency of hurricanes – as acknowledged by the Intergovernmental Panel on Climate Change (IPCC) [2], which provides the official scientific view on climate change’s global impact on weather – but investors in this market continue to monitor events and check their models for any potential change in activity. Changes that could impact the underlying re/insurance risks could be due to an uptick in frequency or severity of weather-related catastrophes, but also underlying issues that can exacerbate losses – namely, increasing concentrations of property and wealth in areas more prone to natural disasters, like coastlines and wildland-urban interfaces.

In order to monitor weather activity, ILS managers use outputs from catastrophe risk simulation models developed by leading modelling firms such as Applied Insurance Research (AIR) and Risk Management Solutions (RMS). For U.S. hurricanes, for example, these models have been calibrated with over a century of hurricane data covering periods of both high and low hurricane activity to create a long-term profile for hurricane risk. Transactions can be evaluated and portfolio risk can be analyzed against these models.

These catastrophe models usually report two numbers indicating hurricane risk. First, a long-term number that gives hurricane loss statistics based on the observed hurricane record from 1900 to present day. The current scientific literature does not suggest that this underlying long-term risk profile has yet changed [3], but most models also provide a second near-term number that comes from assuming possible impacts of climate change on hurricane activity by using historical years when the Atlantic Ocean has been warmer than average – and therefore closer to current sea surface temperature conditions – to calibrate the models.

These different views allow fund managers to assess the sensitivity of specific ILS transactions and their portfolios to potential climate-related changes to hurricane activity. Recent events, such as the wildfires in California, while heart-breaking disasters for those affected, have provided vital data points to test and improve prevailing models and has allowed investors to conduct climate sensitivity analyses for wildfire risk as well.

Stepping back, from a purely financial point of view, both climate change and inflation potentially erode long-term real return expectations. Current expectations for the impact of climate change and inflation are both at relatively mild levels. However, it is projected impact that drives much of the concern in terms of both climate change and monetary policy. Inflation is typically forecast out no more than 10 years. In contrast, climate change projections focus on much longer time horizons — typically 50 to 100 years or more.

While some traditional investments are highly vulnerable to the long-term impacts of climate change, ILS can re-price their returns to climate change "inflation" in the near term.

With this in mind, it is important to focus on asset duration when it comes to climate change vulnerability. ILS with the longest tenor are usually cat bonds, which typically have a term of up to only a few years at issuance. Many ILS are relatively short one-year investments mirroring the annual renewal of the underlying insurance policies they back-stop. On the other hand, homes, cities and large-scale infrastructure exist on a multi-decadal timescale. While some traditional investments are highly vulnerable to the long-term impacts of climate change, ILS can re-price their returns to climate change "inflation" in the near term.

This means that the architecture of the ILS market – like the re/insurance market more broadly – is that of a “climate linker”, and ILS can be thought of as “climate-indexed floating rate” investments. In the context of ILS, investors stand a chance of being adequately compensated for climate change risk. Furthermore, by providing a forward-looking market-based indication of the costs of weather risks, these instruments provide an important pricing signal for society to incentivize effective mitigation and adaptation measures for the long-term.

The disaster events of 2017 and 2018 highlighted the significant need for external capital to support the global traditional reinsurance balance sheet. This need is particularly great for those ‘peak peril’ exposures where traditional capacity limits have been reached. These areas are experiencing rapid economic and employment growth that outpaces re/insurance capital supply, creating a growing “disaster gap”. ILS investors are stepping in to fill the gap between the capital base of the re/insurance industry and the potential re/insurance losses from natural catastrophe events.

By providing this structural capital to the global re/insurance industry to set against the possibility of rare but damaging catastrophes, ILS have a beneficial impact on the global economy and on society in general. Investors are therefore also increasingly considering the positive, ESG qualities of ILS, particularly when they are used by public institutions as tools to manage risk and support better disaster preparedness and response.

An interesting example of this is a cat bond sponsored by the global Pandemic Emergency Facility (PEF) – a World Bank facility established with the support of the World Health Organisation. This innovative cat bond provides pre-emptive relief to catastrophic breakouts of viral pandemics such as Ebola and influenza. From a narrow financial perspective, the beneficial impact of this bond is considerable. Early action funding has a multiplier effect — one dollar spent on containment early in the stages of a multi-country pandemic is worth over one hundred dollars of treatment later. This allows the World Bank to justify its intention to offer investors a positive, long-term return for holding these bonds.

ILS instruments are helping to reduce the economic impact of disasters on the lives of those affected by supporting financial mechanisms that provide predictable, efficient, and effective responses to at-risk communities.

The Government of Mexico has also been using cat bonds to manage its hurricane and earthquake risk since 2006. The bonds are designed to trigger payouts quickly after a disaster occurs to enable a rapid and efficient response to those affected. Following a strong earthquake in September 2017, for example, Mexico received a $150 million payout from a bond issued on its behalf by the World Bank. The payout was used to support the reconstruction and rehabilitation of damaged public infrastructure and housing in affected areas [4]. Here, ILS instruments are helping to reduce the economic impact of disasters on the lives of those affected by supporting financial mechanisms that provide predictable, efficient, and effective responses to at-risk communities.

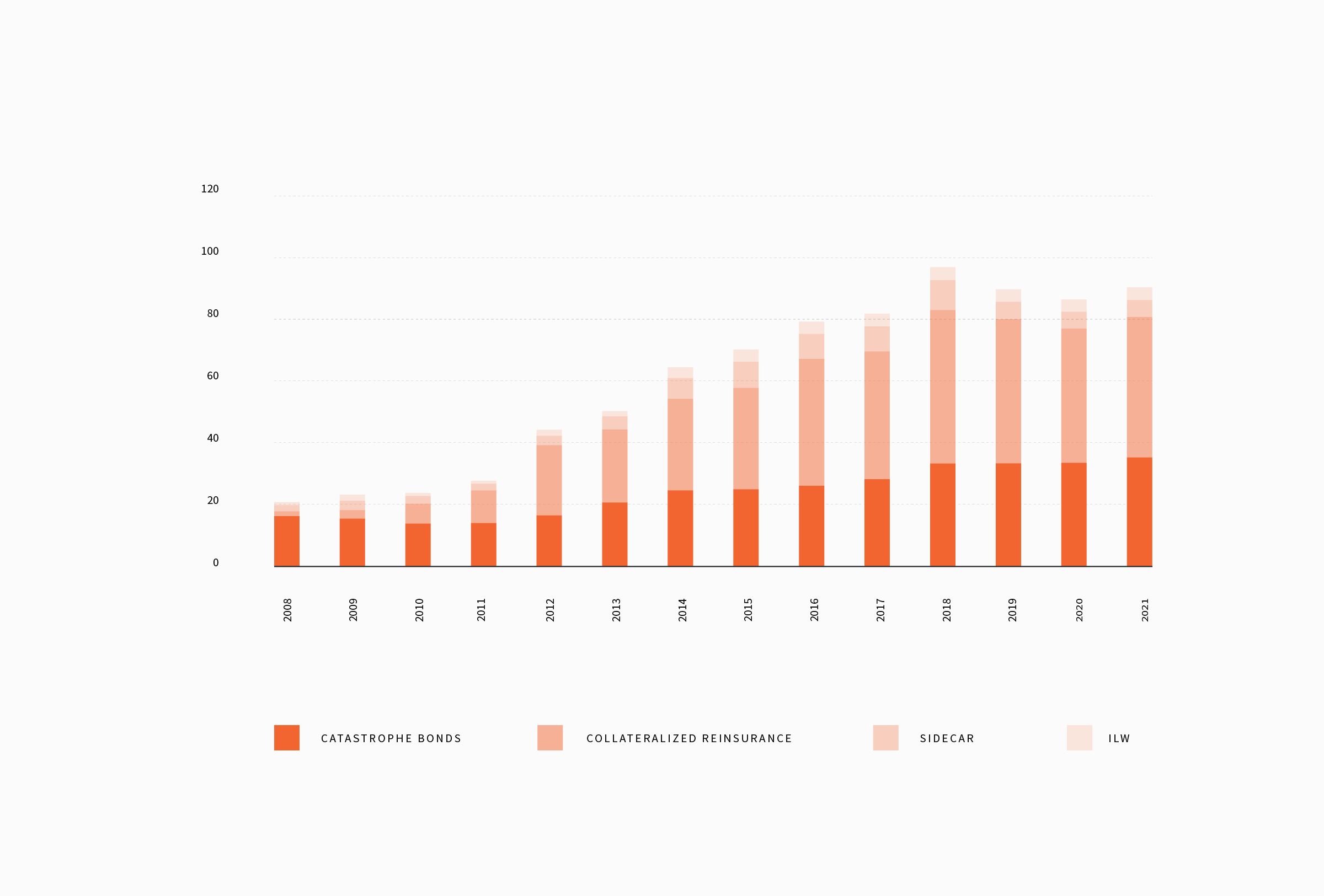

The ILS market is set to reach a key milestone — a market size that exceeds the $100 billion mark [5] — and last year saw a number of large landmark cat bond issuances. The World Bank returned to the market, transferring earthquake risk on behalf of the Pacific Alliance countries Chile, Columbia, Mexico, and Peru. The U.S. Federal government, for the first time, transferred flood risk to the market on behalf of the U.S. National Flood Insurance Program. These transactions herald an inflection point in public risk transfer and reflect an increasing trend in sovereign policies and actions. The intent is to de-risk public balance sheets and to protect taxpayers from the financial impact of catastrophic disasters. Public risk transfer like this will form an increasingly significant piece of sustainable and recurring risk transfer to the sector going forward, creating a new cornerstone for the ILS market and a new avenue for growth.

These exciting developments for the market underscore that demand for capital in this asset class has not been invented as a solution for investors. Instead, it is a response to a critical and growing need from the re/insurance industry and from society as a whole. As the market becomes more supply driven over the coming years, the investor base will widen further. For providing this structural capital solution for the global re/insurance marketplace, the world’s economies, and societies, ILS investors are rewarded with attractive and uncorrelated risk-adjusted returns.

ILS market growth in USD billions by year.

USD billions on y-axis.

Source: Aon Benfield Analytics and Fermat Capital Management, LLC. Data as of June 2022.

ILS market growth in USD billions by year.

USD billions on y-axis.

Source: Aon Benfield Analytics and Fermat Capital Management, LLC. Data as of June 2022.

Resources:

[1] In this note we use the term re/insurance to refer collectively to insurance companies and reinsurance companies.

[2] Source: “Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change” by IPCC, 2014: See in particular the summary statements on page 53 of the report: https://www.ipcc.ch/site/assets/uploads/2018/02/SYR_AR5_FINAL_full.pdf

[3] Source: “Global Warming and Hurricanes: An Overview of Current Research Results” by Geophysical Fluid Dynamics Laboratory, National Oceanic and Atmospheric Administration, 2018 (https://www.gfdl.noaa.gov/global-warming-and-hurricanes/)

[4] https://www.wsj.com/articles/mexico-to-collect-150-million-from-catastrophe-bond-1507684294

[5] Source: “Reinsurance Market Outlook” by Aon January 2019 (http://thoughtleadership.aonbenfield.com//Documents/20190104-ab-analytics-rmo-january.pdf)

Last Updated June 2021